Metrics that matter

There are so many complicated mathematical formulas and metrics that you could use when trying to optimize your personal finances. Many of them are difficult to understand and will add unnecessary complexity to your life, but there are a few that are simple enough for you and I to wrap our heads around completely and can be incredibly powerful in gaining an understanding of where we’re at currently and where we’re going. Here are 4 important metrics to track along your personal finance journey.

1. Net worth

This is possibly the most important metric in all of personal finance. Your net worth is your assets (the monetary value of everything you have accumulated) minus your liabilities (any debts you owe). It’s the sum of all of your money in checking, savings, retirement or other investment accounts, plus the value of any real estate, vehicles, furniture, household items, etc. minus any debt you have (credit cards, car loans, student loans, mortgages, personal loans, etc.)

ASSETS - LIABILITIES = NET WORTH

Your net worth matters because it is the first step in getting to your FI number (more on this next). Someone who is a millionaire has a net worth of at least one million dollars.

You should track your net worth on an annual basis, we recommend doing it at the beginning of each year. Use a spreadsheet or a finance app to track your net worth like this.

Eventually, you’ll want to separate your investment assets (money in accounts) from your use assets like your primary residence and vehicles since those won’t directly add to your financial independence.

Ideally, your net worth is going up each year. There are a couple of key milestones that can be fun to track towards.

- Positive net worth

If you calculate your net worth and come to a negative number, that’s okay! But your first goal is to get that to a positive number.

- Net worth > annual salary

The next milestone to look for is when you have a net worth that is greater than your annual salary. This is a good indicator that you are on the right track.

- Millionaire

If this seems like too big of a leap, you can add in milestones for $250k, $500k, and $750k net worth to keep you motivated. The only true definition of a millionaire is someone with a net worth of one million dollars or more. Once your net worth is calculated at $1M, you’re a millionaire! This is a huge milestone that, contrary to popular belief, average people can attain.

- Your FI number

This is where you’ll want to separate investment assets from use assets, as mentioned above. FI stands for Financial Independence. More on how to find this number in the next section, but in short, it’s the liquid net worth you need to be able to retire.

2. Your FI number

This is your Financial Independence number. It represents the amount of money you need to be financially independent (no longer dependent on something external like a job to cover your financial needs).

Everyone’s FI number is different. To calculate yours, take your annual expenses times 25. Make sure to include both monthly expenses like rent or mortgage, utility bills, etc. as well as less frequently recurring bills like property taxes or certain insurance premiums.

If someone’s annual expenses are $50,000, their FI number would be $1,250,000. See our article on 401k investing if this amount scares you – it’s very achievable!

2.1 The 4% Rule

This is the rule that explains your FI number. This rule simply states that you can withdraw 4% of your nest egg, indefinitely, and never run out of money. The math is just the inverse of the calculation for your FI number.

50,000 x 25 = 1,250,000

or

1,250,000 x .04 = 50,000

Make sure to do your own research before buying into exactly 4% as your safe withdrawal rate. Some financial experts and advisors will recommend slightly higher or slightly lower withdrawal rates. Either way, 4% is a great target to use as you work through your own journey to financial independence.

3. Investment Rate

This is an important metric to track as you’re working towards increasing your net worth on your way to FI (financial independence). Your investment rate is the percent of your gross annual income you are putting to work for the future. Any amount being put in a 401k, Roth IRA, or other investment accounts will be in your numerator. Your total gross annual income is your denominator.

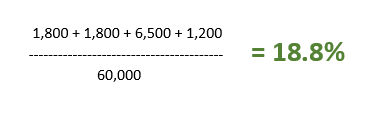

Let’s say someone has a gross annual income of $60,000, contributes 3% to a 401k with a 3% match, maxes out a Roth IRA (annual max is $6,500 at the time of this writing), and puts another $100 per month into a brokerage investment account.

This person’s investment rate is 18.8%. Most financial experts recommend an investment rate between 15 and 25%.

4. Rate of return

Although the news headlines will disagree, this is probably the least important metric mentioned in this article. The reason for that is that it’s the one that you have the least control over. Your rate of return is the rate at which your investments grow over time. You can track your personal rate of return from wherever you are investing your money.

Historically the stock market has, on average, returned somewhere around 10% on an annual basis. We believe in investing in low-cost index funds and low-cost target retirement index funds – with these fund types, you will usually be following the market trends (through the ups and downs) rather than trying to beat the market (which we believe is a fool’s errand).

We would caution against taking any action based on your personal rate of return, so long as you are investing wisely (again, index funds and target retirement index funds). Remember, time in the market beats timing the market. A good investment plan works in good times and bad, bull markets and bear markets.

Knowing and tracking these numbers will help make sure you stay on the right path to personal finance success. We hope you found this article entertaining and insightful, thank you for reading.